Despite the already strong run, Dye & Durham Limited (TSE:DND) shares have rallied 26% over the past thirty days. The latest month caps a massive 141% increase over the past year.

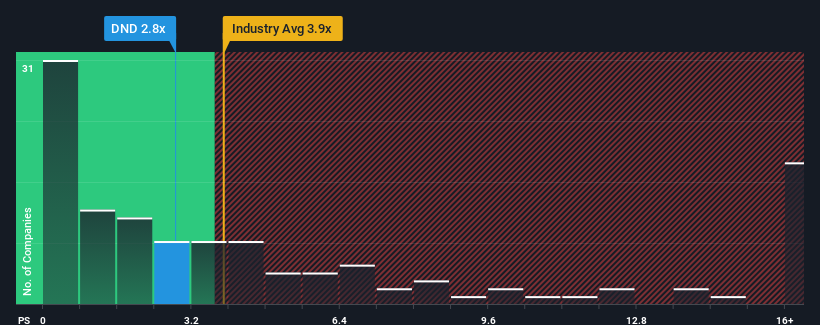

Although its price has risen, Dye & Durham can still send buy signals at the moment with a price-to-sales ratio (or “P/S”) of 2.8x, considering almost half of all companies in the software industry in Canada have P/S ratios greater than 3.9x and even P/S greater than 8x are not uncommon. Regardless, we’ll have to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis on Dye & Durham

How Dye & Durham Performs

Recent times have not been good for Dye & Durham as their revenue has grown more slowly than most other companies. Perhaps the market expects the current trend of weak earnings growth to continue, keeping the P/S depressed. If this is the case, then existing shareholders will likely struggle to get excited about the future direction of the share price.

If you want to see what the analysts are predicting going forward, you should check out our for free report for Dye & Durham.

Do earnings forecasts match the low P/S ratio?

To justify the P/S ratio, Dye & Durham will need to produce slow growth that lags the industry.

If we review the revenue of the last year, the company posted a result that is almost no different from a year ago. Still, the last three-year period has seen an excellent overall increase of 119% in revenue, despite an uninspiring short-term performance. So it’s fair to say that recent revenue growth has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 9.5% annually, according to the estimate of the seven analysts covering the company. Meanwhile, the rest of the industry is expected to expand by 20% per year, which is significantly more attractive.

With this information, we can understand why Dye & Durham is trading at a P/S lower than the industry. Clearly, many shareholders have not felt comfortable holding on as the company potentially looks to a less prosperous future.

The last word

The recent share price surge was not enough to lift Dye & Durham’s P/S near the industry median. The price-to-sales ratio is said to be an inferior measure of value in certain industries, but it can be a powerful indicator of business sentiment.

We find that Dye & Durham maintains a low P/S due to the weakness of its forecast growth, which is lower than the broader industry, as expected. Shareholder pessimism about the company’s earnings outlook appears to be the main factor contributing to the lowered P/S. The company will need a turnaround in fortunes to justify a rise in P/S going forward.

Before you make up your mind, we found out 1 warning sign for Dye & Durham that you should be aware of.

If these risks make you reconsider your opinion of Dye & Durhamcheck out our interactive list of high-quality stocks to get an idea of what else is out there.

new: Manage all your stock portfolios in one place

We created the ultimate portfolio companion for equity investors, and it’s free.

• Connect unlimited wallets and see the total amount in one currency

• Be alerted to new warning signs or risks via email or mobile phone

• Track the fair value of your shares

Try a free demo portfolio

Have feedback on this article? Concerned about content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts, using only an unbiased methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or quality materials. Simply Wall St has no position in the stocks mentioned.