Over the past 7 days, the Canadian market has risen 1.0% and is up 27% over the past year, with earnings projected to grow 16% annually. In this context of growth, identifying stocks with solid financial foundations is critical for investors looking for value and potential growth. Penny stocks, while a somewhat outdated term, remain relevant because they often represent smaller or newer companies that can offer significant growth opportunities when supported by strong fundamentals.

Top 10 Penny Stocks in Canada

| Name | Share price | Market capitalization | Assessment of financial health |

| PetroTal (TSX:TAL) | 0.67 Canadian dollars | 620.88 million Canadian dollars | ★★★★★★ |

| Findev (TSXV:FDI) | 0.42 Canadian dollars | 11.75 million Canadian dollars | ★★★★★☆ |

| Winshear Gold (TSXV: WINS) | 0.18 Canadian dollars | 4.4 million Canadian dollars | ★★★★★★ |

| Mandalay Resources (TSX:MND) | 3.34 Canadian dollars | 297.04 million Canadian dollars | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | 2.37 Canadian dollars | 119.71 million Canadian dollars | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | 1.80 Canadian dollars | 303.41 million Canadian dollars | ★★★★★☆ |

| Foraco International (TSX:FAR) | 2.37 Canadian dollars | 221.84 million Canadian dollars | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | 0.04 Canadian dollars | 3.17 million Canadian dollars | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | 0.115 Canadian dollars | 12.14 million Canadian dollars | ★★★★★★ |

| NamSys (TSXV:CTZ) | 1.11 Canadian dollars | 30.89 million Canadian dollars | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks Screener.

Below, we highlight a few of our favorites from our exclusive review.

Assessment of the financial condition of Simply Wall St: ★★★★★★

Overview: Irving Resources Inc. is a junior exploration stage company focused on the acquisition and exploration of mineral properties in Canada and Japan, with a market cap of C$27.61 million.

Operations: There are currently no reported revenue segments for this junior exploration company focused on mineral properties in Canada and Japan.

Market Capitalization: 27.61 million Canadian dollars

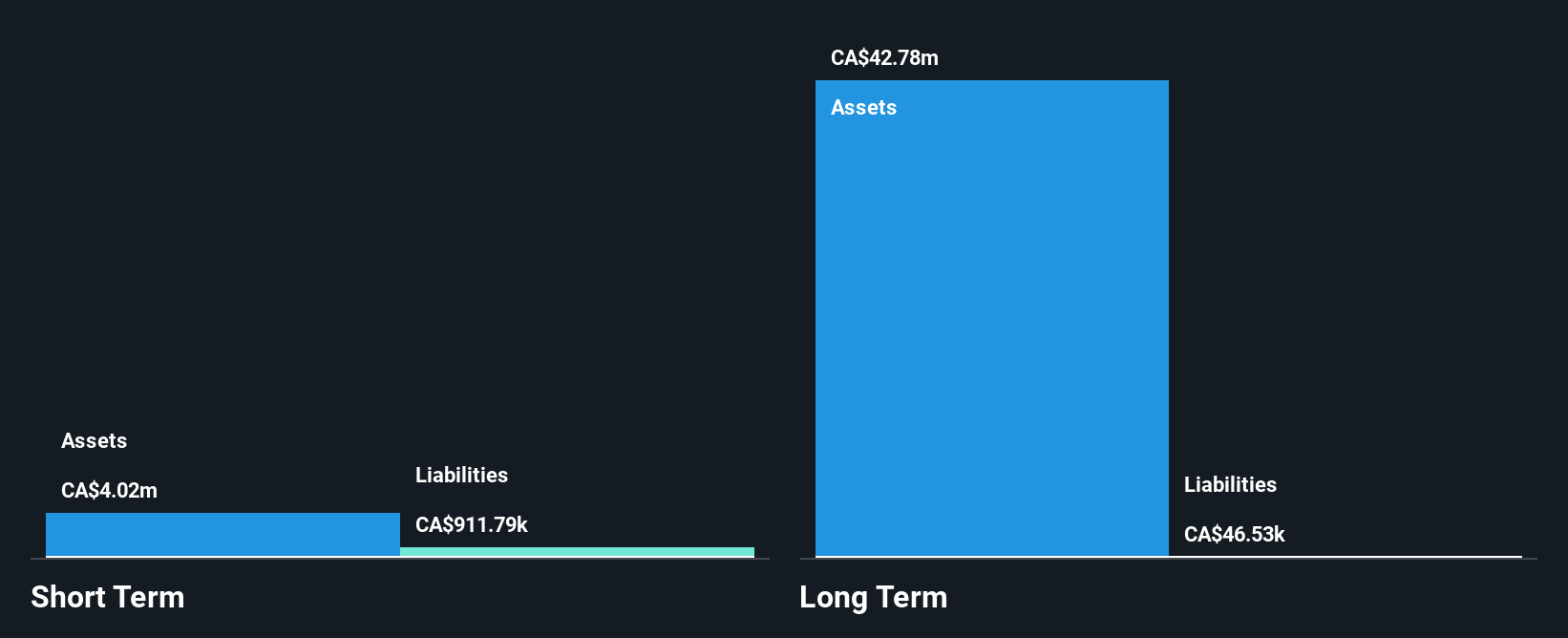

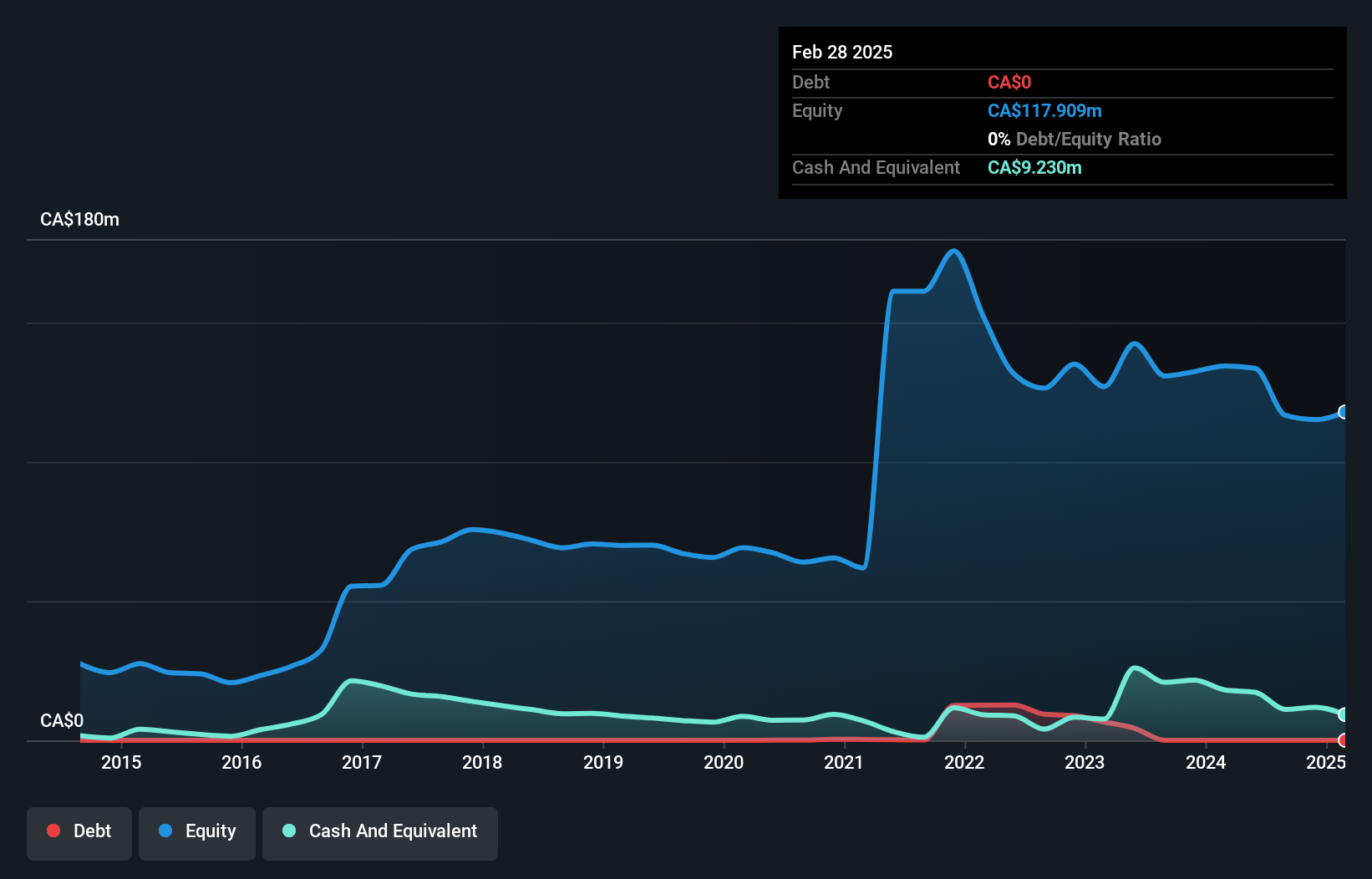

Irving Resources Inc., a pre-revenue junior exploration company, remains debt-free with C$3.6 million in current assets exceeding its current and long-term liabilities. Despite being unprofitable, it has reduced losses over the past five years by 14.9% per year. The company’s share price has been highly volatile recently, and shareholders have experienced dilution of 3.7% over the past year. Irving’s strategic alliance with Newmont Overseas Exploration Limited and Sumitomo Corporation formed a joint venture for his Yamagano and Noto properties, positioning him as the initial manager with potential future management from Newmont.

Assessment of the financial condition of Simply Wall St: ★★★★★☆

Overview: Foraco International SA, with a market cap of C$221.84 million, offers drilling services in North America, Europe, the Middle East, Africa, South America, and the Asia-Pacific region.

Operations: The company’s revenue comes from two main segments: mining, which contributes $297.61 million, and water, which accounts for $39.01 million.

Market Capitalization: 221.84 million Canadian dollars

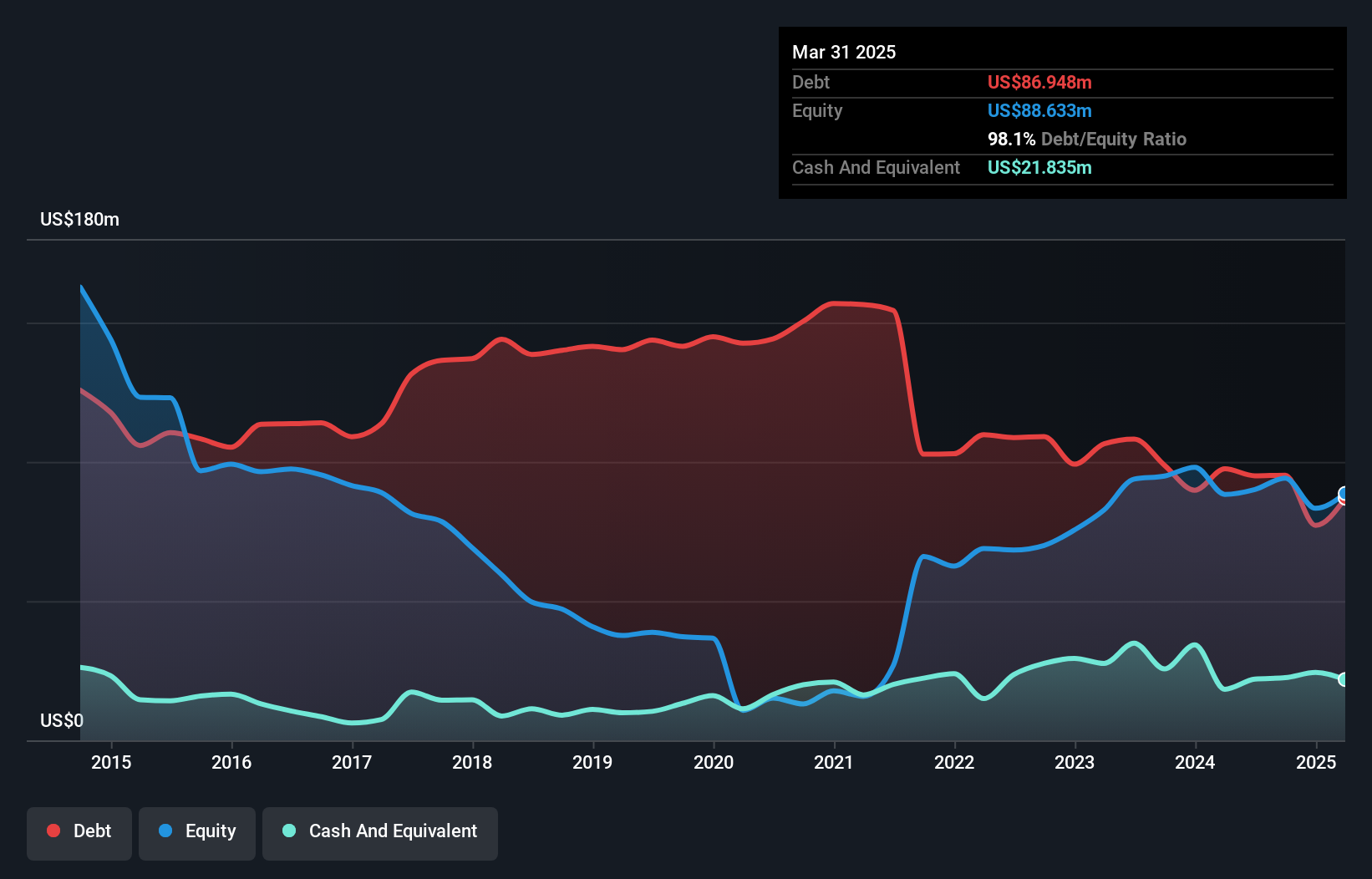

Foraco International SA, with a market capitalization of C$221.84 million, exhibits a mixed financial situation as a penny stock. Despite negative earnings growth last year, the company has shown profitability over five years with a 42.1% annual increase in earnings. The debt-to-equity ratio has improved significantly from 370.2% to 105.4% in five years, although it remains high at 81%. The company’s interest payments are well covered by EBIT and operating cash flow adequately covers its debt at 41.4%. Foraco’s recent share buyback program reflects strategic capital management against a backdrop of stable weekly volatility and high quality earnings.

Assessment of the financial condition of Simply Wall St: ★★★★☆☆

Overview: GoldMining Inc. is a mineral exploration company that focuses on the acquisition, exploration and development of gold assets in the Americas with a market cap of C$257.79 million.

Operations: GoldMining Inc. does not currently report any revenue segments.

Market Capitalization: 257.79 million Canadian dollars

GoldMining Inc., with a market cap of C$257.79 million, remains ahead of earnings and unprofitable, facing challenges typical of penny stocks. The company has no debt and its short-term assets cover both short-term and long-term liabilities, but it has less than a year of cash on hand based on current free cash flow trends. Recent exploration of the São Jorge project in Brazil shows promising potential for gold and copper mineralization, but significant domestic sales have recently occurred. Although it was added to the S&P Global BMI Index, shareholder dilution of 8% over the past year underscores continued financial pressures.

Summing it all up

- Dive into all 947 of the TSX Penny Stocks we’ve identified here.

- Have you already invested in these stocks? Keep up with every twist by building a portfolio with Simply Wall St, where we make it easy for investors like you to be informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free convenient app for visionary investors.

Are you ready to venture into other investment styles?

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts, using only an unbiased methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or quality materials. Simply Wall St has no position in the stocks mentioned.

new: Manage all your stock portfolios in one place

We created the ultimate portfolio companion for equity investors, and it’s free.

• Connect unlimited wallets and see the total amount in one currency

• Be alerted to new warning signs or risks via email or mobile phone

• Track the fair value of your shares

Try a demo portfolio for free

Have feedback on this article? Concerned about content? Contact us directly. Alternatively, email [email protected]